Today, more companies, investors and other stakeholders are looking to scale up their efforts to mitigate climate change, water scarcity, waste volumes, loss of biodiversity and other negative impacts to our environment. While financial reporting remains essential, many companies also recognize that transparency and standardized non-financial ESG reporting (Environmental, Social, Governance) are becoming more important to investors and customers.

There are a number of drivers that are responsible for this trend. For example, in 2015, the 17 UN Sustainability Development Goals (SDGs) were introduced as part of Agenda 2030. Specifically, in SDG 12.6, the goal is to “Encourage companies, especially large and transnational companies, to adopt sustainable practices and to integrate sustainability information into their reporting cycle.” The purpose of this SDG is to clearly establish that organizations understand, communicate and better manage their contributions to advance the 2030 Agenda for Sustainable Development.

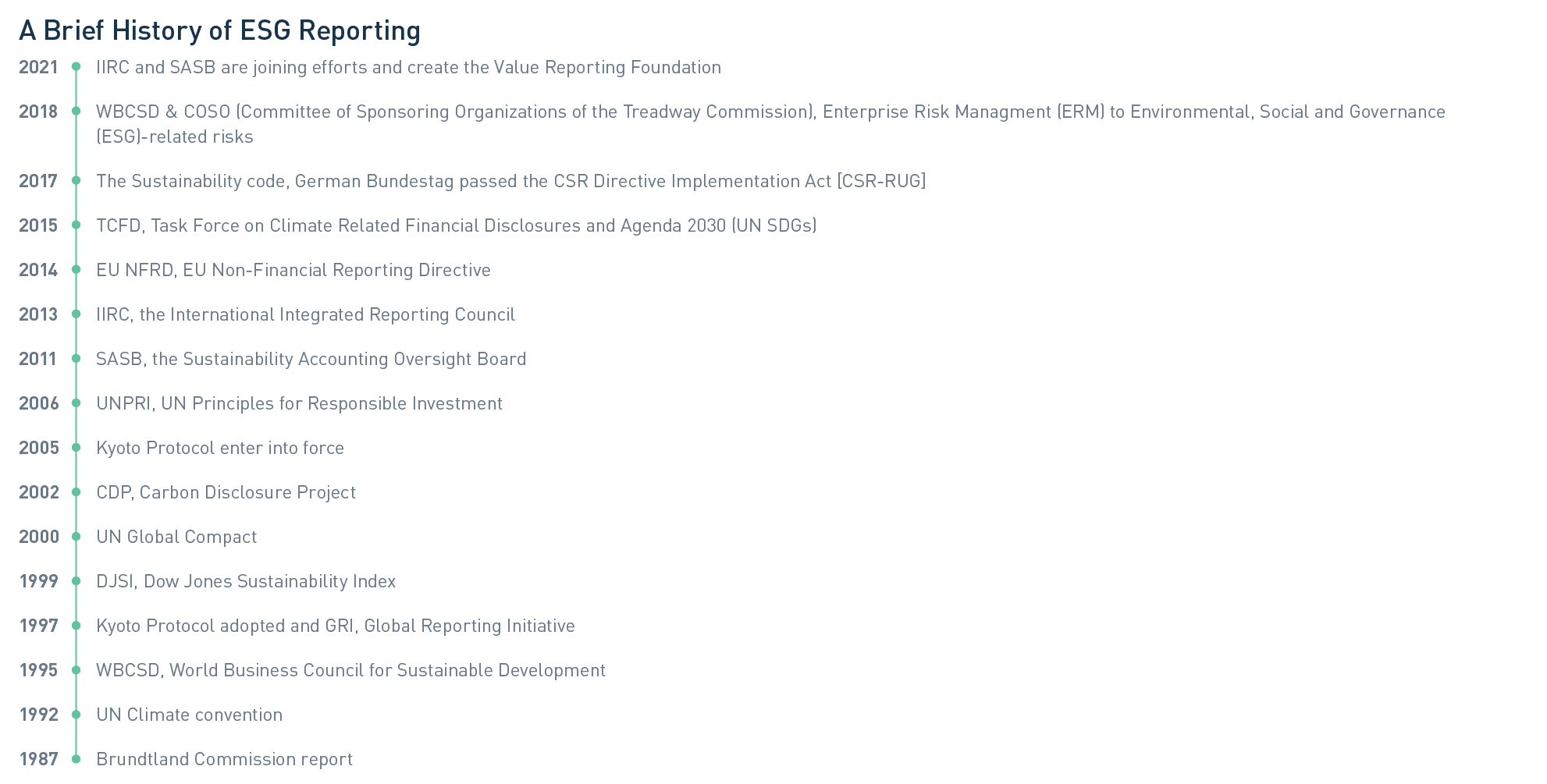

When Solenis began its journey to implement non-financial reporting for ESG, it became apparent how challenging it was going to be to accurately measure impacts and present them transparently to demonstrate progress. A quick review of the history of ESG reporting makes these challenges clear. Since the Brundtland Commission report was released in 1987 and introduced the concept of “sustainable development,” interest in ESG reporting accelerated, and as a result, a number of organizations emerged in an attempt to bring order to the concept of sustainability reporting (see Figure 1).

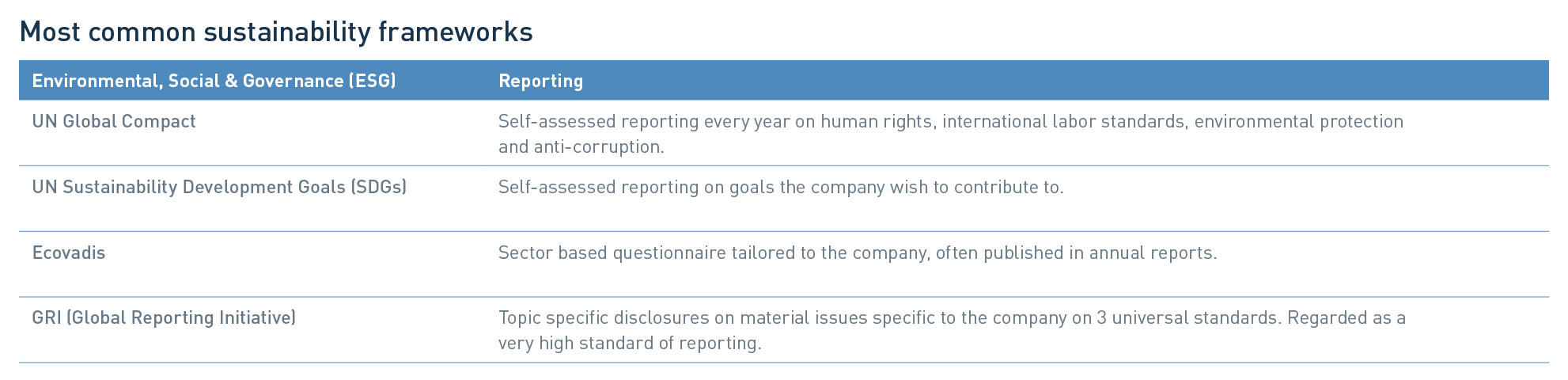

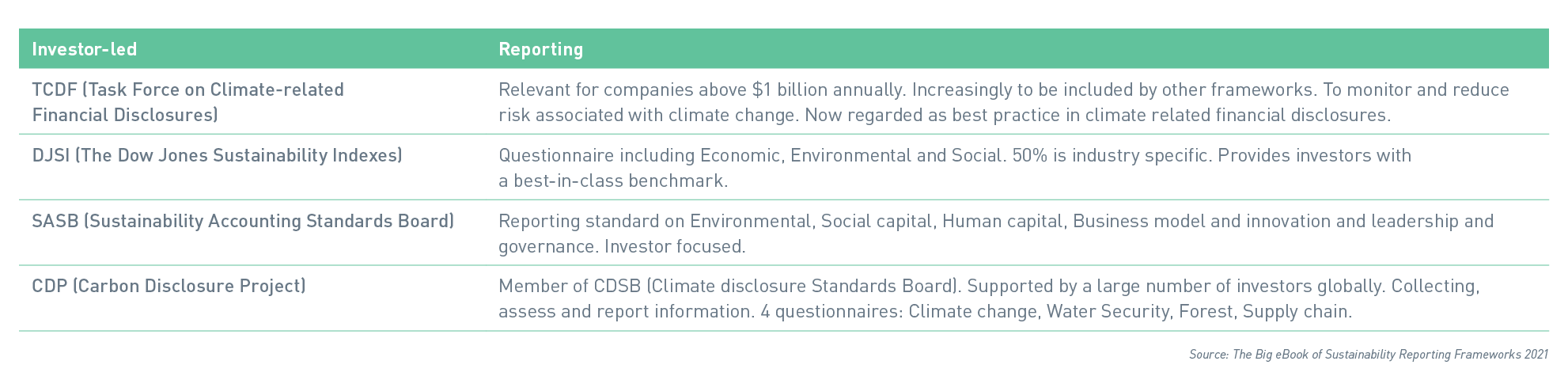

Unfortunately, rather than bringing clarity to the situation, these efforts resulted in the development of several different global standards for reporting. The most common of these are listed in the table below, and more details about them can be found in The Big eBook of Sustainability Reporting Frameworks 2021.

A Review of Reporting

Identifying the best ESG reporting methodology that leads to positive change has been a key issue Solenis has struggled to solve. Investigation of the various frameworks and best practices led us to some key takeaways.

According to statistics published in The KPMG Survey of Sustainability Reporting 2020, 96 percent of the 250 largest companies in the world (G250) reported on sustainability-related topics. In addition, eighty percent of the so-called N100 companies (5,200 companies — the largest 100 companies in 52 countries) were also reporting. The Global Reporting Initiative (GRI) is in use by approximately two-thirds of N100 reporters and approximately three-quarters of G250 companies. Clearly, the survey indicated a general consensus among leading businesses that the GRI is a widely accepted framework. The survey also indicated the need for third-party external review of a company’s sustainability report. For G250 companies today, such external review is a part of 71 percent of their reports.

Then, in September 2020, a group of five leading voluntary frameworks — including CDP, the Climate Disclosure Standards Board (CDSB), GRI, the International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) — published its Statement of Intent to Work Together Towards Comprehensive Corporate Reporting. The new document described their shared vision of the elements necessary for more comprehensive sustainability reporting, including the criteria defined by the Task Force on Climate-related Financial Disclosures (TCFD). The group committed to work closely with key players, such as the International Organization of Securities Commissions (IOSCO), International Financial Reporting Standards Foundation (IFRS), European Commission and the World Economic Forum’s International Business Council, to drive towards the goal of comprehensive reporting.

As this work progressed, it became evident that companies could use both GRI and SASB together in their reporting framework because each has a slightly different focus. SASB Standards have a more industry-focused perspective and identify a subset of issues that are likely to be financially material for the company in that specific industry. GRI standards are focused more on the economic, environmental and social impacts of a company’s activities.

SASB and GRI jointly published on April 4, 2021, A Practical Guide to Sustainability Reporting Using GRI and SASB Standards. “This joint research demonstrates how companies successfully use the GRI and SASB Standards to provide the depth and breadth of disclosure that their many stakeholders, including investors, require,” said Janine Guillot, CEO of SASB.

“By sharing practical experiences, we are enabling companies to determine the sustainability reporting path that is right for them, based on the needs of their stakeholders. I believe it will improve understanding of the differences between GRI and SASB Standards and, importantly, ways in which they can be used concurrently,” said Eric Hespenheide, GRI Chairman.

This drive towards consolidation and cooperation of reporting frameworks continues. On June 9, 2021, IIRC and SASB officially announced their merger to form the Value Reporting Foundation.

Materiality Assessments

In addition to a reporting framework, many companies build their sustainability strategy on a materiality assessment. This assessment is the process used to identify and assess potential environmental, social, and governance issues (material topics) that could affect a business and/or its stakeholders. The result of this analysis provides the material topics to shape the company strategy, identify targets and define its reporting around ESG. For example, material topics can be aligned to both the UN SDGs and GRI standards. GRI writes on its website that “Good sustainability reporting begins with a well-founded materiality assessment. Communicate your materiality assessment clearly and accurately with your stakeholders and show them how you uphold the quality of your reporting.”

In 2020, Solenis undertook its first data-driven materiality assessment using the Datamaran software, a cloud-based data analytics platform, to identify and prioritize our key material topics. By conducting a materiality assessment, we confirmed, verified, and prioritized key sustainability issues relevant to our business, through the lens of key stakeholder groups (customers, employees and investors). As a result, we defined well-being, health and safety of employees and customers, protecting our planet, partnerships in our value chain, and governance and compliance as our sustainability pillars.

Sustainability at Solenis

For Solenis, we decided to build our first full sustainability report around GRI as the most common framework/reporting standard in the world. We created clear targets and KPIs that also align to the five UN SDGs that we believe we can have the biggest impact — through our customers, products, processes and partnerships. In our Solenis Sustainability report [starting on page 17], we visually depict how the three strategic lenses, the four pillars for sustainability, the material topics and the SDGs build the foundation of our ESG strategy.

Is it enough for Solenis to only use the GRI framework for reporting in the future? This is unlikely, as sustainability reporting will almost certainly continue to evolve. For example, in a Boston Consulting Group/World Economic Forum white paper, “Embracing the New Age of Materiality: Harnessing the Pace of Change in ESG,” the authors describe how investors are considering how what is financially immaterial to a company or industry today can become material tomorrow, a process called “dynamic materiality.” The speed at which issues become material is accelerating due to how information is shared. One outcome could be constant review and updating of materiality assessments to ensure the company strategy and resulting reporting are relevant and up to date.

At Solenis, we are fully committed to be the Leading Sustainability and Service Solutions Provider for Water-Intensive Industries. We will continuously improve our transparency and measure our progress towards clearly defined targets and KPIs in all areas of ESG. We will continue to monitor sustainability trends, risks and opportunities facing our business with a yearly updated materiality assessment and monitoring of changes in legislation. And, of course, we are committed to be transparent and publish an annual, externally reviewed Sustainability Report.

To learn more about sustainability at Solenis, visit the sustainability pages on Solenis.com. Or download a copy of our most recent Sustainability Report.