While pulp and paper manufacturers have long considered themselves part of a sustainable industry due to their use of virgin fibers and recycled paper, they are feeling various impacts as consumers and governments increase pressure on businesses in all industries to reduce their environmental impact. China’s Blue Sky initiative to reduce overall air pollution has forced smaller, inefficient paper manufacturers to close. Meanwhile, Western European papermakers are defining how they will produce renewable goods that are free from plastic packaging, which lowers their carbon footprint. And North American and Latin American manufacturers are making efforts to respond to a heightened interest from consumers for products that are sustainable and compostable.

Non-wood pulps, which can replace trees as a raw material for pulps, have reemerged recently as a solution for papermakers looking to meet environmental and sustainability targets — even though the true environmental impact of switching to non-wood pulps is still under investigation. Solenis is part of a consortium trying to answer this very question by working to generate a detailed lifecycle analysis that compares tissue produced from wood with tissue produced from non-wood pulps. This blog provides an analysis of the current production and discusses forecast pulp production and market considerations as they relate to paper production.

An Overview of the Non-Woods Market

Alternative fibers, including bamboo, bagasse, hemp, wheat straw, flax, and reed, have been a niche fiber source for many years. Interest in these fibers began primarily in China and the Asia-Pacific region, but non-wood pulps are produced today in all regions of the world.

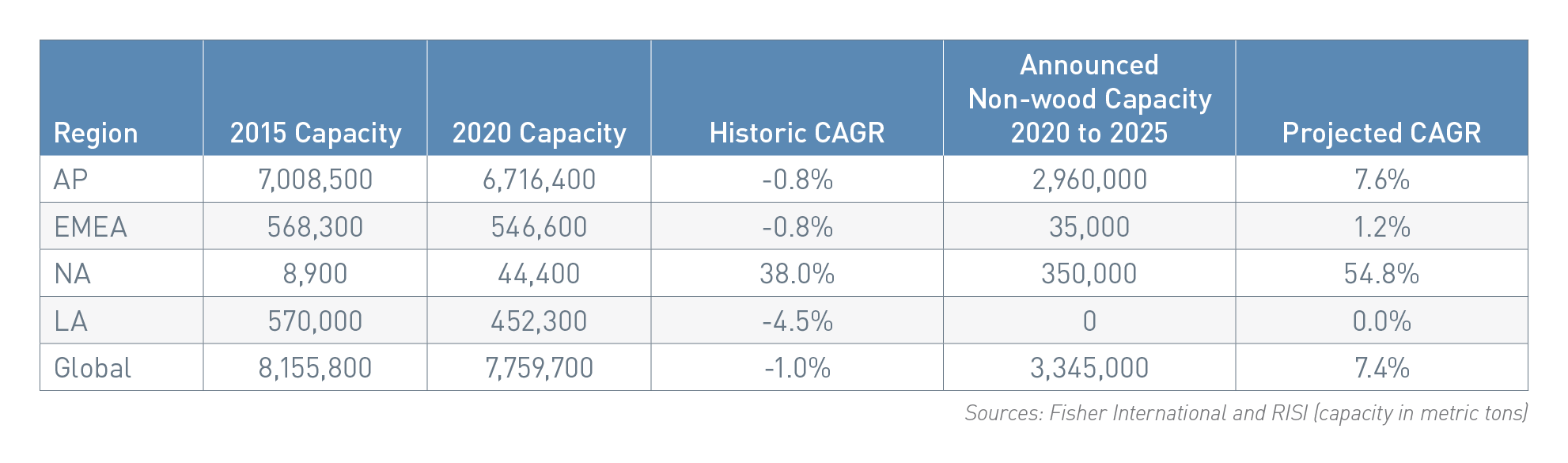

Despite this, data from Fisher International shows that non-wood pulps represent only 5 percent of global pulp production, with modest growth over the next four years, spurred by the increased use of bamboo pulps, which are becoming more common in the production of soft tissue. Asia is projected to expand non-wood production by nearly 8 percent annually by 2025. Europe will see only modest growth in non-wood pulp production, and Latin America will see no growth at all. The biggest increase in capacity will be in North America, due primarily to the reopening of a wheat straw line at Columbia Pulp in Lyons Ferry, Washington.

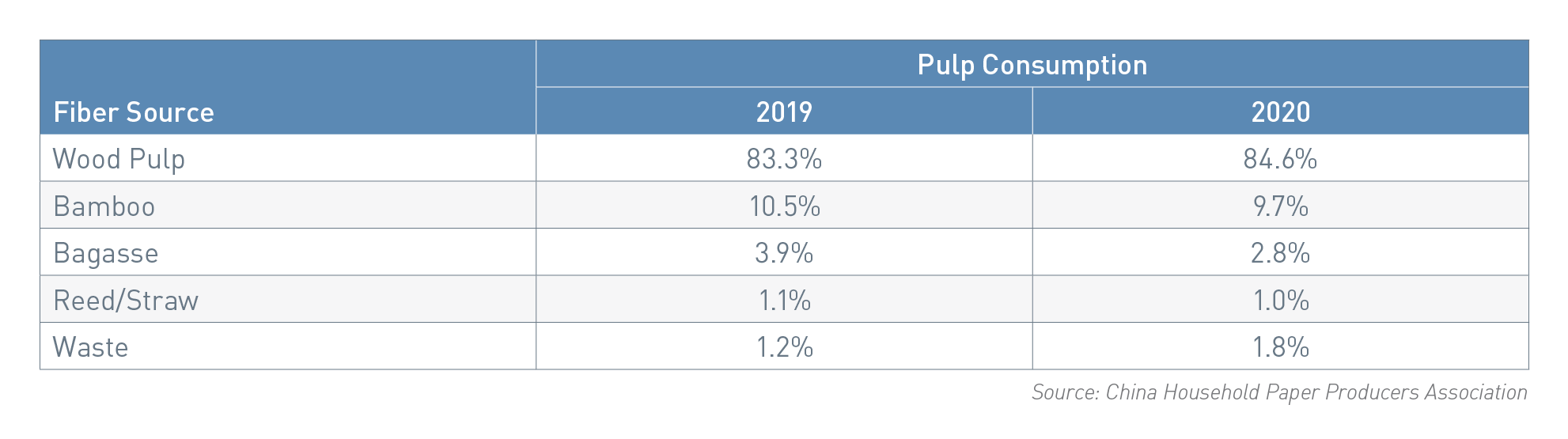

Slow growth for non-wood pulps is also predicted by the China Household Paper Producers Association, which recently presented pulp use by furnish type, comparing 2019 and 2020 percentages for the tissue segment’s overall pulp consumption. The percentage of non-wood pulp used declined from 15.5 percent in 2019 to 13.6 percent in 2020, representing a reduction of approximately 200,000 metric tons. The market itself is experiencing an oversupply of roughly five million tons of excess capacity, impacting China’s smaller manufacturers the hardest. These producers are likely taking downtime or operating at a reduced utilization rate for non-wood pulp. With China’s ban on the importation of certain wastepaper streams cutting supplies of recyclable paper, it’s possible a higher proportion of non-wood pulp consumption may be utilized in packaging instead of tissue products.

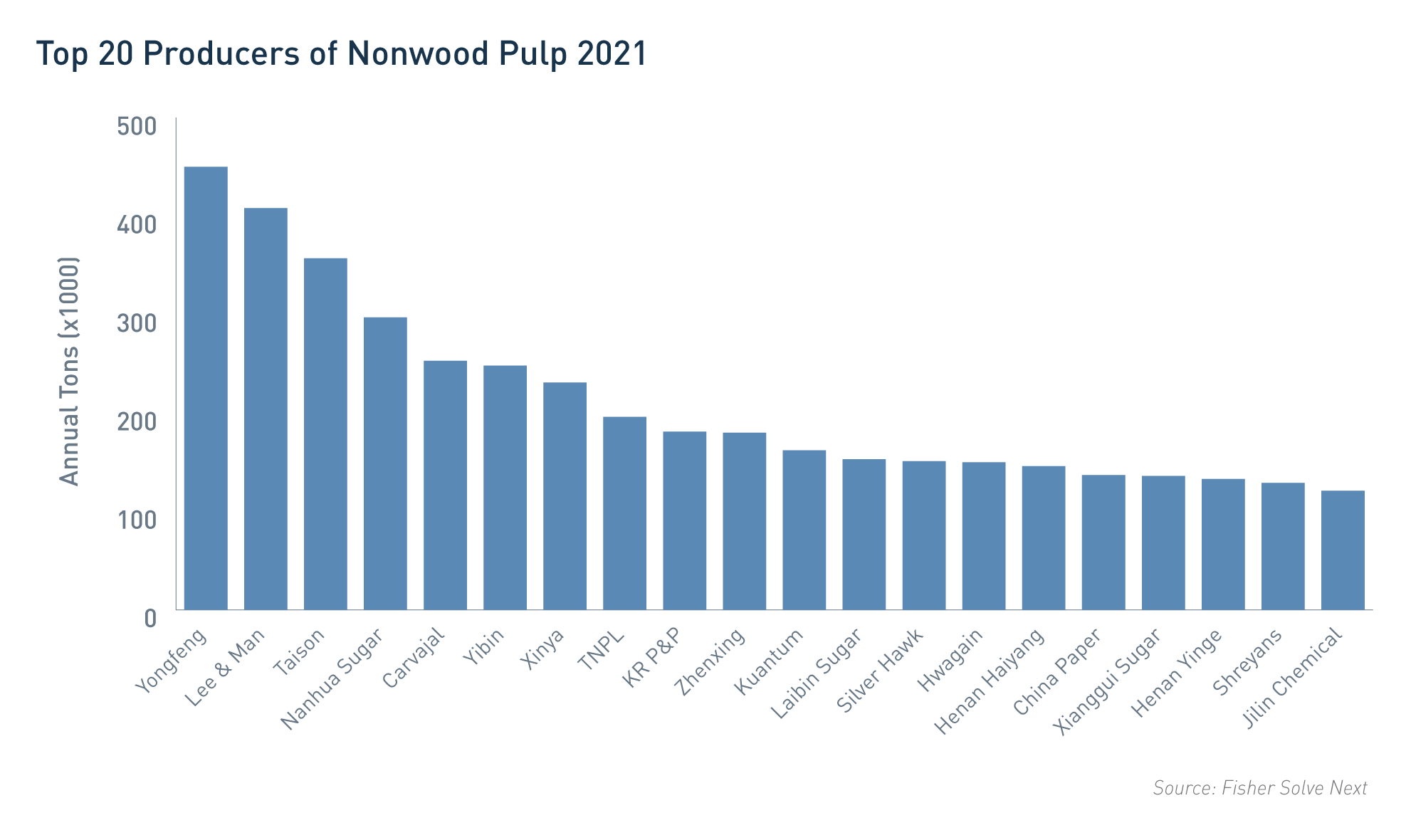

In the Asia-Pacific region, the top producers of non-wood pulp are supplying furnish primarily for the tissue towel industry, with more than 40 percent of production supporting this market. The balance of the non-wood furnish is consumed by packaging and graphic and specialty papers.

The Benefits of Bamboo

Bamboo is by far today’s top source of non-wood pulps. Among consumers, interest in bamboo as an alternative fiber has gained support for several reasons:

- Customers view products made from plants other than trees as a more environmentally sound option compared to wood. This concept has been reinforced by the fast growth rates of plants with a higher pulp yield, such as bamboo.

- Bamboo is harvested by cutting the stalk but leaving the root intact, which can reduce deforestation.

- Bamboo captures more carbon dioxide and releases more oxygen while requiring less maintenance than trees.

- In areas where forestry options are limited, bamboo and other non-wood products offer a viable option as a fiber source.

For pulp manufacturers, bamboo is the easiest non-wood fiber to pulp, allowing for conventional chippers and similar cooking conditions to hardwood, which enables the fiber to be used in conventional continuous digesters.

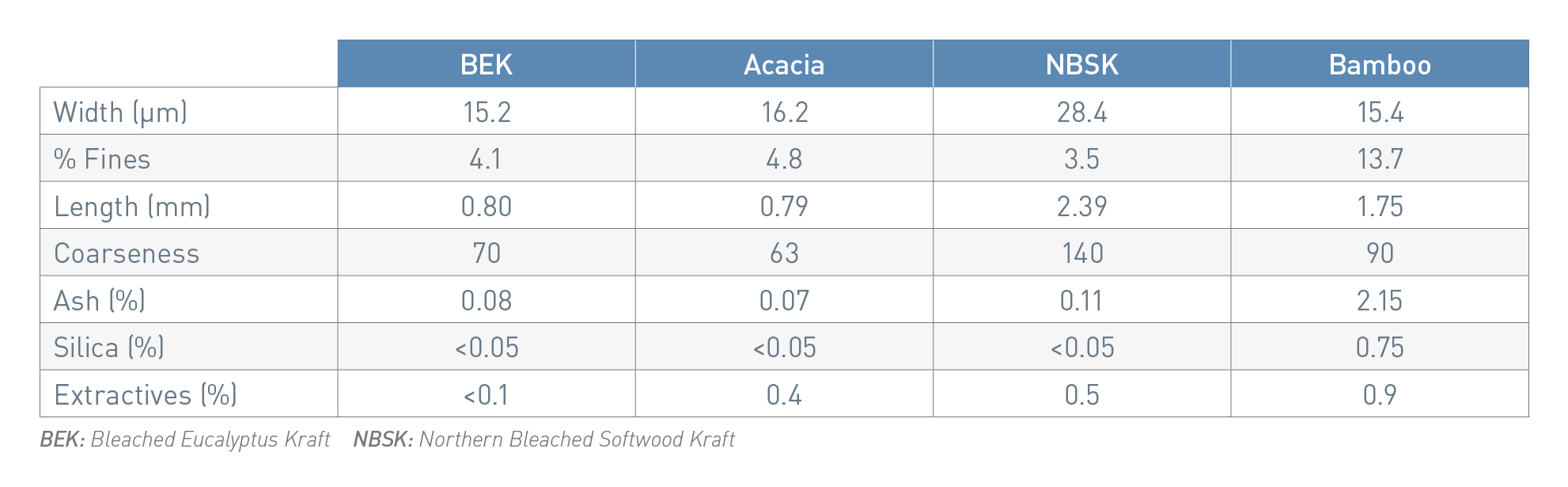

Papermakers using bamboo see tensile strength values somewhere between hardwood and softwood pulps, but bamboo delivers significantly higher burst and tear results. The use of bamboo has become more common in producing soft tissue where fiber morphology, particularly fiber width and coarseness, helps with softness.

The table below illustrates the similarities and differences in fiber properties for traditional wood fibers and bamboo. Levels of contaminants, such as ash, silica, extractives and fines content, are notably higher in bamboo and require proper management of mechanical refining and chemical treatment programs.

BEK: Bleached Eucalyptus Kraft

NBSK: Northern Bleached Softwood Kraft

The Challenges of Bamboo

Higher levels of contaminants and fines can cause problems for tissue makers if operational changes are not made. Contaminants and fines will make Yankee coating harder and abrasive, resulting in an increasingly dusty process. Without adjusting the coating program and/or using a fines management program to compensate, these conditions will reduce sheet softness and hand feel, decrease runnability and increase doctor blade changes.

Mills that purchase bamboo in market pulp form should experience fewer issues when compared to integrated mills, since pulp drying will remove some contaminants. Also, tissue makers will likely need to adjust their chemical programs to achieve operational and sustainability goals. Silica control additives for use in the pulp mill, updated Yankee coating technologies, deposit control solutions and fines control programs all will help increase uptime and reduce defects. Working with a chemical supplier that has extensive experience in the tissue and towel market can help customers meet challenging quality and operational performance requirements using innovative AI technologies and products for creping, wet strength, dry strength, softness and machine cleanliness.

If you would like to learn more, please explore our website to read about Solenis’ approach to sustainability and our family of solutions for the tissue and towel industry.